Top Ten Things to Pack for a Memorable Camping Experience

Camping is an incredible way to escape the hustle and bustle of your daily routine, immerse yourself in nature, and recharge your mind, body, and soul. Whether you’re a seasoned camper or this is your first time, you must be adequately prepared to make the most of your trip. While a stress-free camping experience is not entirely guaranteed, having the right gear and equipment can significantly improve your chances of enjoying your trip.

Top Things To Pack Camping

Cooking Gear and Food

Cooking up a delicious meal outdoors can be a highlight of your camping experience, but you need to pack your kitchen essentials. Some of the necessary items include a portable stove, fuel, pots, pans, utensils, and a cooler. Also, remember to pack enough food, snacks, and drinks to last the trip. TIP: If you don’t have running water, fill a spray bottle with water and a squirt of dish soap to wash your dishes.

Lighting Equipment

Once the sun goes down, you’ll need a reliable light source to help you navigate your campsite and avoid tripping over roots or rocks. Pack a lantern, headlamp, or flashlight, and bring extra batteries to keep your light sources up and running. TIP: Charge a solar motion detector light during the day and place in front of your door; as you approach, the light will turn on.

First Aid Kit

Even if you’re not prone to accidents, a first aid kit is essential for emergencies. Your kit should include band-aids, antiseptic wipes, gauze, pain relievers, and prescription medications. Consider if it is allergy season and pack your allergy medicine, Aloe/After Sun if you are going to be in the sun, and muscle rub if you are going to be doing strenuous activities.

Maps and compass

While smartphones can provide GPS navigation, they are not always reliable in remote locations. Grab a map and compass, and learn how to use it before you hit the trails.

Insect Repellent

Don’t let bugs ruin your camping trip. Insect repellent is a must to keep mosquitoes, ticks, and other biting insects at bay. Pack some anti-itch cream for any bites you may endure.

Portable Power Bank

Even if you’re camping to escape everyday life, you might still need to charge your phone or camera. Pack a portable power bank and ensure it is fully charged before leaving.

Entertainment Options

While camping is all about enjoying nature, there will be times when you need to relax at your campsite. Pack books, games, a deck of cards, or a guitar to keep yourself entertained while you take a break.

Preparing for your camping trip with the right gear and equipment is essential to ensuring a successful, enjoyable experience. The list of items to pack for your camping trip may seem endless, but focusing on the above items should set you on the right path. Start packing early to give yourself ample time to get everything you need, and remember to pack everything securely and safely. Now, all that’s left is to enjoy your camping trip and create unforgettable memories.

Live Love Prescott

I love everything about Prescott! If you are considering moving to Prescott – or upgrading your current home – I would love to help! (928) 458-4025

Open House Food To Impress Buyers

Open House Food Tips

If you’re hosting an open house, you’ll want to ensure you have some food available. Here are 10 open-house food ideas that will make your open-house a success:

1. Finger foods. Finger foods are always a hit at any party, and an open house is no exception. Consider offering some bite-sized appetizers that your guests can quickly grab and go.

2. Fresh fruit. Fresh fruit is a great way to ensure your guests have something healthy to nibble on.

3. Veggies and dip. Another healthy option that your guests are sure to love is veggies and dip. Offer a variety of chopped veggies, along with a variety of dips.

4. Cheese and crackers. Cheese and crackers is another classic open-house food option your guests will love. Be sure to offer a variety of cheeses, as well as some gluten-free crackers for those with dietary restrictions.

5. Sandwiches. Sandwiches are always a good option if you want to offer something a little more substantial. You can make them beforehand or set everything up so your guests can build their own.

6. Soup. Soup is another excellent option for an open house, especially if it’s chilly outside. Set up a crockpot with your favorite soup and let your guests help themselves.

7. Chili. Chili is another great option for an open house, especially if you’re expecting many people. Set up a crockpot with your chili and let your guests help themselves.

8. Dessert. No open house is complete without some dessert! Offer your guests a variety of cookies, brownies, or other sweets.

9. Coffee and tea. Make sure you have coffee and tea and some sugar and milk available for your guests if they want it.

10. Water. Don’t forget the most important beverage of all: water! Be sure to have plenty of water for your guests to stay hydrated.

By following these open-house food ideas, you’re sure to make your open-house a success!

Selling homes is my specialty! When you are ready to sell, give me a call, and together we can make your home sale a smooth and successful process!

Liz Norvelle

(928) 458-4025

Below are a few recipes from Better Homes and Gardens, BHG.com, that would be a great addition to your Open-house!

DIY Pimento Cheese

Ingredients

- 2 cup shredded sharp cheddar cheese (8 ounces)

- ½ cup mayonnaise

- ¼ teaspoon paprika

- Kosher salt

- Freshly ground black pepper

- ¼ cup jarred pimentos or roasted red pepper, drained and chopped

Directions

- In a medium bowl stir together cheese, mayonnaise, and paprika. Season to taste with salt and black pepper. Pat pimentos dry with paper towels; fold into cheese mixture.

Sausage Balls

Ingredients

- 1 pound pork sausage

- 1 cup biscuit mix

- 2 tablespoons milk

- 8 oz shredded sharp cheddar cheese

- 1/4 cup grated parmesan cheese

- 2 tablespoons chopped fresh chives

Directions

- Preheat oven to 350°F. Line a large rimmed baking sheet with parchment paper. In a large bowl, combine the ground sausage and baking mix. Using hands, thoroughly mix until combined, adding milk 1 Tbsp. at a time as needed. Add cheeses and chives; mix well. Divide mixture into about 1 1/2 Tbsp portions and roll into 1 1/2- inch balls. Arrange on prepared pan.

- Bake until lightly brown, 15 minutes. Serve immediately.

6 Key Tips for Selling Your House This Spring

We are fully into Spring, which means more and more people are getting their homes ready to sell. With that comes the added stress of making sure you get the best price for your home. Here are six essential tips to help you maximize your chances of a successful sale:

- Hire an Agent: First and foremost, hire an agent. Their experience in the realty industry and local market will be invaluable for setting a fair price and marketing your house to potential buyers.

- Don’t Limit the Days Sellers Can View Your Home: If you limit the days people can view your home, you limit the number of potential buyers who can come by and consider it. By making yourself more accessible to buyers, you will increase your chances of getting more offers. If it’s not accessible, it could cost you by sitting on the market longer and ultimately selling for a lower price.

- Make Your Home Inviting: Get rid of any clutter, give the house a good cleaning, and make sure it has good curb appeal. Consider fresh paint, new fixtures in the kitchen or bathroom, and minor upgrades that can give it a modern feel without breaking the bank.

- Curb Appeal: The old saying, “You never get a second chance to make a first impression,” matters when selling your house. So make sure buyers have an immediate positive feeling when driving up. Simple steps like mowing the lawn, trimming shrubs, and adding a few plants can make your home attractive to potential buyers.

- Price it Right: As much as you may feel your home is unique and worth more, price it right. Lean on your real estate agent to give you the best advice on a fair ballpark price. Ultimately, the market will determine your home’s actual value.

- Consider Staging: Professional stagers can help you create the best possible impression of your home by staging it in the most inviting way. Or look at virtual staging services, which can help you create a 3D model of your home to give buyers an idea of what it looks like furnished.

Everyone selling their home wants three things: to sell it for the most money they can, to do it in a certain amount of time, and to do all of that with the fewest hassles. To accomplish these goals, let’s connect so you can understand the steps you need to take to sell your home this Spring.

Boosting Your Curb Appeal this Spring

Spring is the perfect time to get your real estate on the market. There’s no better way to make a good first impression than by boosting your home’s curb appeal. Compared to a few years ago, homes today need more preparation to generate buying interest. Although inventory is still historically low, updated homes priced at market value are the quickest selling. Chief Economist Danielle Hale states, “In a market where costs are still high and buyers can be a little choosier, it makes sense they’re going to really zero in on the homes that are the most appealing.”

That’s why ensuring your home stands out in the real estate market is essential. First, work with a trusted real estate agent who can help you understand the most valuable improvements in your local market. Secondly, understand that curb appeal may not generate a higher sale, instead it may aid in a quicker sale. Investopedia states, “Curb-appeal projects make the property look good as soon as prospective buyers arrive. While these projects may not add a considerable amount of monetary value, they will help your home sell faster—and you can do a lot of the work yourself to save money and time.”

Curb Appeal Projects to Consider

You’ll want to focus on the areas of your home that will be immediately noticed. Here are a few smaller tasks you can accomplish in preparation for potential buyers:

- Power washing the exterior walls and walkways

- Freshening up landscaping with grass seed, mulch, and flowers

- Pressure washing the driveway

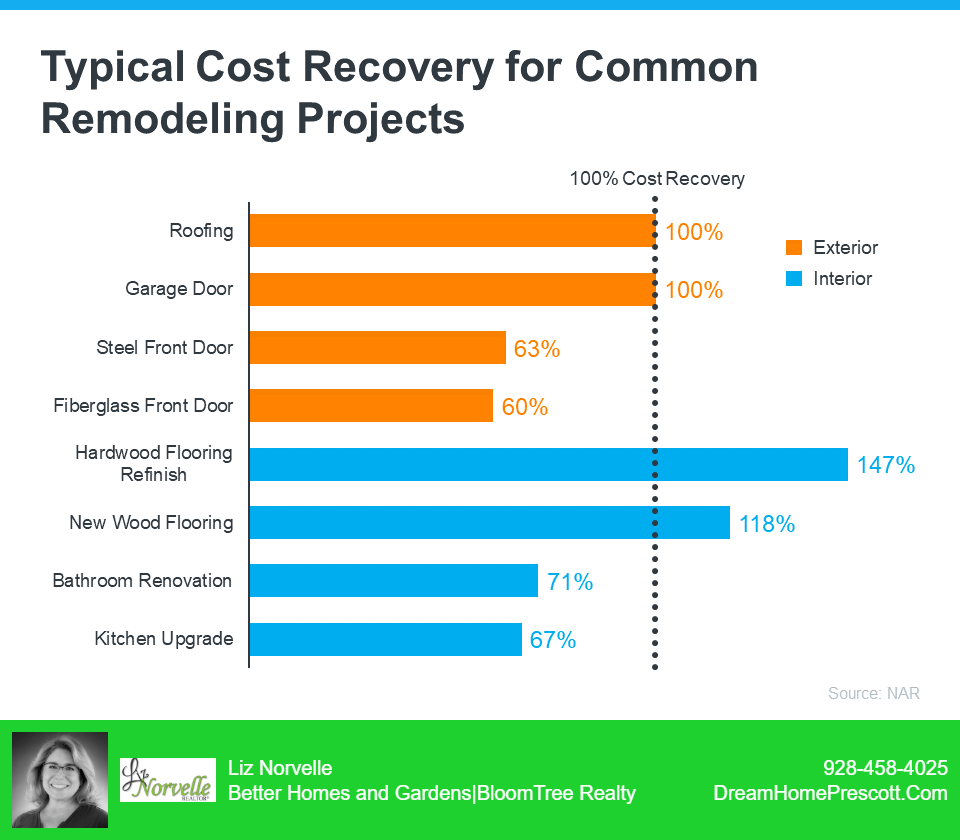

As for larger projects, the 2022 Remodeling Impact Report from the National Association of Realtors (NAR) highlighted that these home improvements bring a larger return on your investment:

- Garage Door: A new garage door can yield an outstanding 100% return on investment.

- Roofing: Replacing a roof is costly but can yield an impressive 100% return on investment.

- Steel Front Door: A steel door replacement can deliver a 63% return on investment.

- Fiberglass Front Door: A fiberglass replacement can generate a 60% return on investment.

As stated above, consult with real estate experts. With the proper guidance and knowledge, you can gain an edge over other homes on the market. Contact me today, I would love to help you with all of your real estate needs!

Liz Norvelle believes that building a relationship based on respect and trust is what truly matters.

The exceptional customer service that Liz provides will establish the groundwork for a relationship with her clients that will continue into the future when you’re ready for your next home or when friends and family come to join you in your new home town.

Please contact Liz, she will take the time to get to know you and assist you in finding a home that best fits your lifestyle needs.

Opportunities for a Seller in Today’s Market

Real estate is always a hot topic and with good reason. The market has changed significantly in the last few years, and this latest season has undergone more shifts. The number of homes for sale is rising as buyer demand slows. Uniquely, this shift offers sellers key opportunities and benefits when selling.

You Have More Options for Your Move

Higher mortgage rates have created low buyer demand. This has helped cool down the frenzy of buyer demand that has occurred over the past couple of years. As a seller, this seems like a downside, but this could benefit you.

If you’re selling your house to make a move, you’ll have more options for your home search. You have to opportunity to be choosier in your next home purchase and find a home that checks all of your boxes.

The Number of Homes on the Market Is Still Low

While the number of homes on the market is increasing, it’s still low when you compare it to historic numbers, making the housing supply firmly in sellers’ market territory. A balanced market to meet buyer demand holds six months’ supply of homes. According to the latest report from the National Association of Realtors (NAR), there was only a 3.3 months supply in July 2022.

Because inventory is still low, if you price your home correctly, there will still be high demand. NAR recorded that the average home in July 2022 sold in as little as 14 days and received multiple offers.

Your Equity Has Grown by Record Amounts

Danielle Hale, Chief Economist at realtor.com, states that “Home owners trying to decide if now is the time to list their home for sale are still in a good position in many markets across the country as a decade of rising home prices gives them a substantial equity cushion . . .”

These last few years of home price appreciation have significantly boosted your home equity. That equity may be just what you need to cover a significant portion (if not all) of the down payment on your next home.

If you have been thinking about selling and are wondering if now is the right time for you, contact me today!

I’m honest, fair, ethical and I have expert level knowledge of our market. I’m a fierce negotiator and I will always put your interests first. I will sell your home for it’s highest value and best terms to help you get where you want to be. My Buyer representation is of the highest quality and I have expert level knowledge of the real estate contracts to help get your offer accepted. My relationships with others in my industry are very important and there are numerous real estate agents, title agents, lenders, home inspectors and surveyors that know me, trust me and want to work with me.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link